Why use mass payouts?

High-volume disbursements crush traditional banking rails. Wires crawl, card networks charge steep percentages, and global coverage is patchy. Mass payouts package every recipient into one blockchain transaction, delivering:

Same-day settlement across borders

Fractional network fees amortised over the whole batch

Cleaner reconciliation with a single hash and batch report

24/7 uptime — even on holidays

Advantages of mass payouts

with crypto

Everything you need to launch and scale your crypto payment service, without the complexity or cost of building from scratch.

Cost control

One signature equals one gas fee — often just cents per recipient.

Built-in transparency

Every batch lives forever on-chain, ready for auditors.

Rapid liquidity

Fund once, pay thousands; treasury cycles move faster.

Universal reach

Pay wallets, exchanges, or custodians in 180+ countries.

What is mass payout?

A mass payout is a consolidated transfer that bundles multiple outgoing payments into one blockchain transaction. Think of it as a digital envelope: the chain records a single outbound value, while OmyPayments automatically fans that value out to every listed recipient.

How mass payouts work

Choose network and stablecoin

Select the network (Ethereum, BNB Smart Chain, or Tron) and stablecoin.

Set payment details

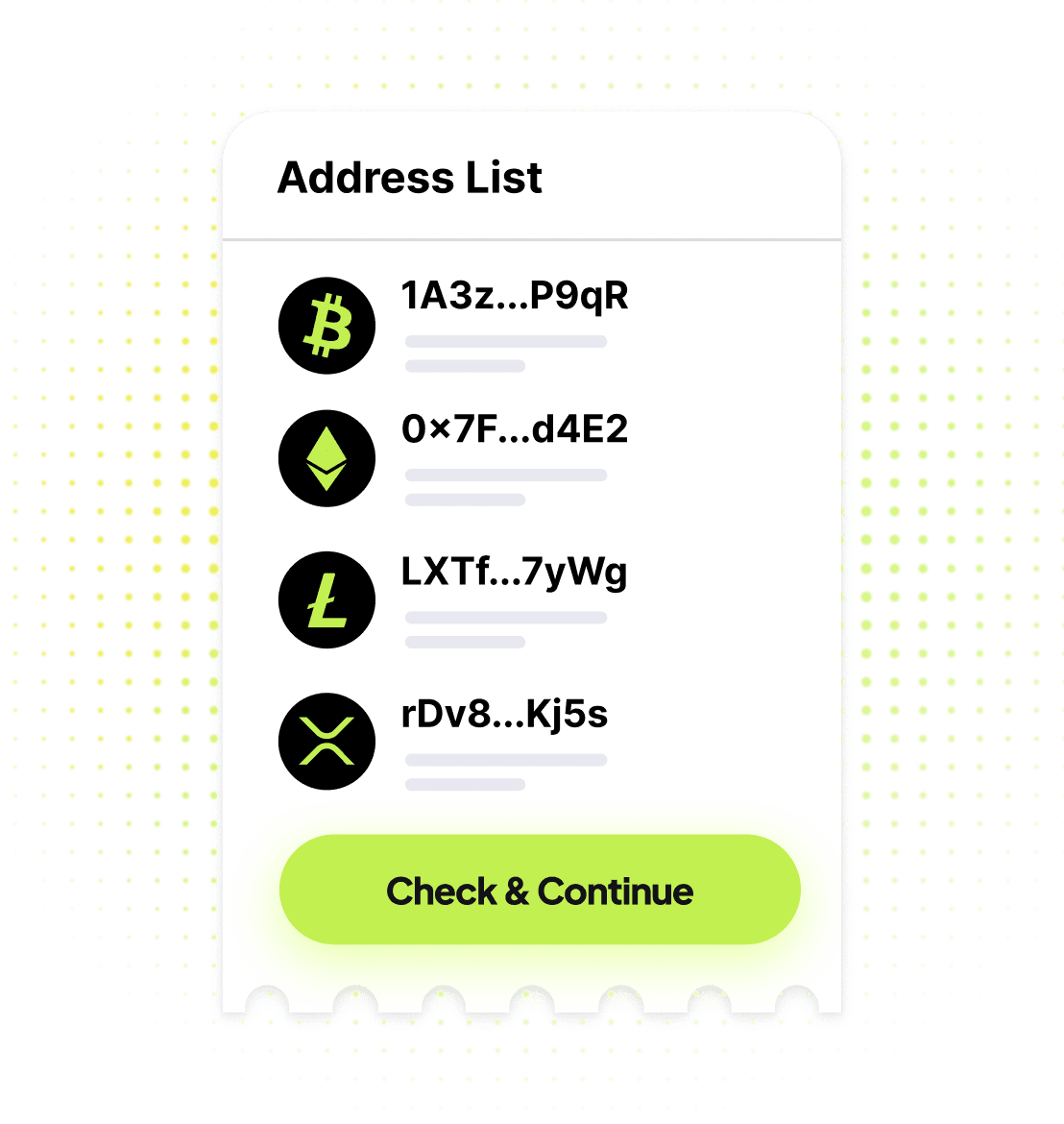

Paste wallet addresses and amount — or upload a pre-formatted file.

Review payment

Review totals, view the all-in network fee, and press «Make payout».

Wait for the automatic sending

OmyPayments broadcasts one transaction when the mempool is calm.

Funds delivered in minutes

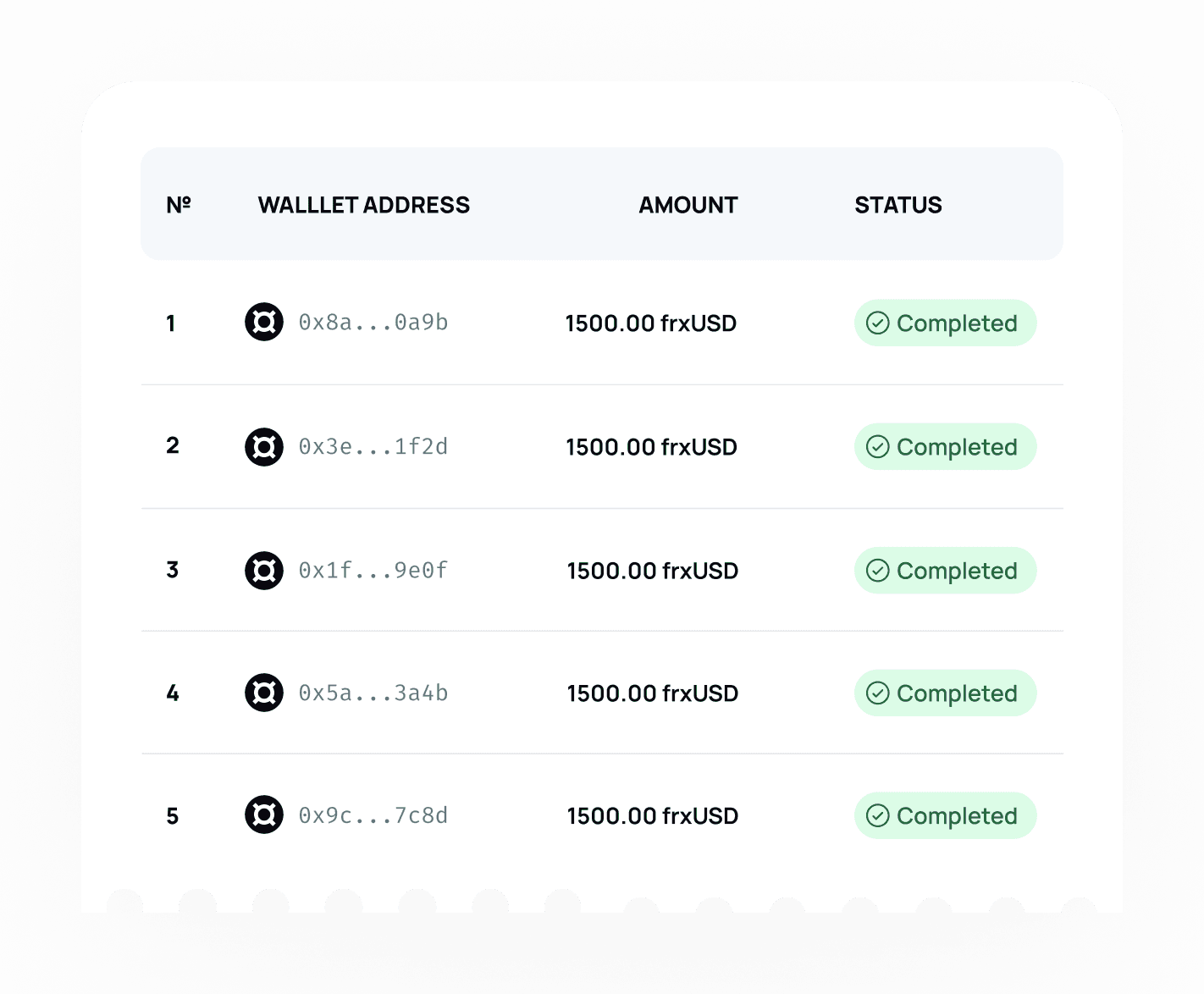

Recipients see funds in minutes; download the batch report with one immutable hash.

Mass-payout delivery methods

API / Webhooks

Automate directly from payroll, marketplace, or billing systems.

Dashboard

Upload a CSV or manual entry—perfect for finance teams.

Integration process

Create and secure your workspace

Sign up, enable two-factor authentication, and set approval roles so the right people can review each batch.

Fund the account

Deposit stablecoins directly or pay a fiat invoice / bank transfer if you want OmyPayments to convert the funds into stablecoins before payout.

Integrate with your platform

Choose the network and token, then export a clean recipient file from your HRIS, CRM, or ERP — wallet address, amount, optional memo.

Upload and validate

Drop the file (or paste rows) into the dashboard. OmyPayments checks address format, chain alignment, and totals before anything goes on-chain.

Review and approve

Finance confirms the batch details, sees the all-in network fee, and clicks Make payout. A second approver can sign if your policy requires it.

Broadcast and reconcile

The platform sends one transaction, returns a single hash, and generates a downloadable batch report that imports straight back into accounting.

Industries that benefit

from mass payouts

Remote payroll

Distributed companies can pay employees in multiple countries at once, without juggling local banks or dealing with multi-day wire delays.

Creator and influencer platforms

Streaming, tipping, and royalty apps often owe hundreds of small payments every day. A single batch keeps operational overhead low while creators receive funds almost instantly.

Affiliate marketing networks

Monthly or weekly commission cycles move smoothly when thousands of partners are paid in one consolidated transaction instead of individual transfers.

Online marketplaces

After a sales period closes, escrowed customer funds can be released to sellers in bulk, reducing reconciliation work and keeping merchants satisfied with faster cash flow.

B2B SaaS commission schemes

Software vendors that share recurring revenue with resellers or referral partners can automate those splits as scheduled mass payouts, avoiding manual exports and spreadsheets.

Gig-economy apps

Ride-hailing, delivery, and freelance task platforms typically pay out to drivers or contractors daily or weekly; batching prevents fee leakage on small-ticket amounts.

Cross-border vendor settlements

Agencies and procurement teams settle invoices for freelancers or suppliers located around the world, sidestepping costly correspondent banking by sending one on-chain batch in stablecoins.